Venture investment in South Korea to reach $5.4B in 2022, down 12% from last year

Reading Time: 3 minutes

The Ministry of SMEs and Startups announced the 2022 venture capital investment trends.

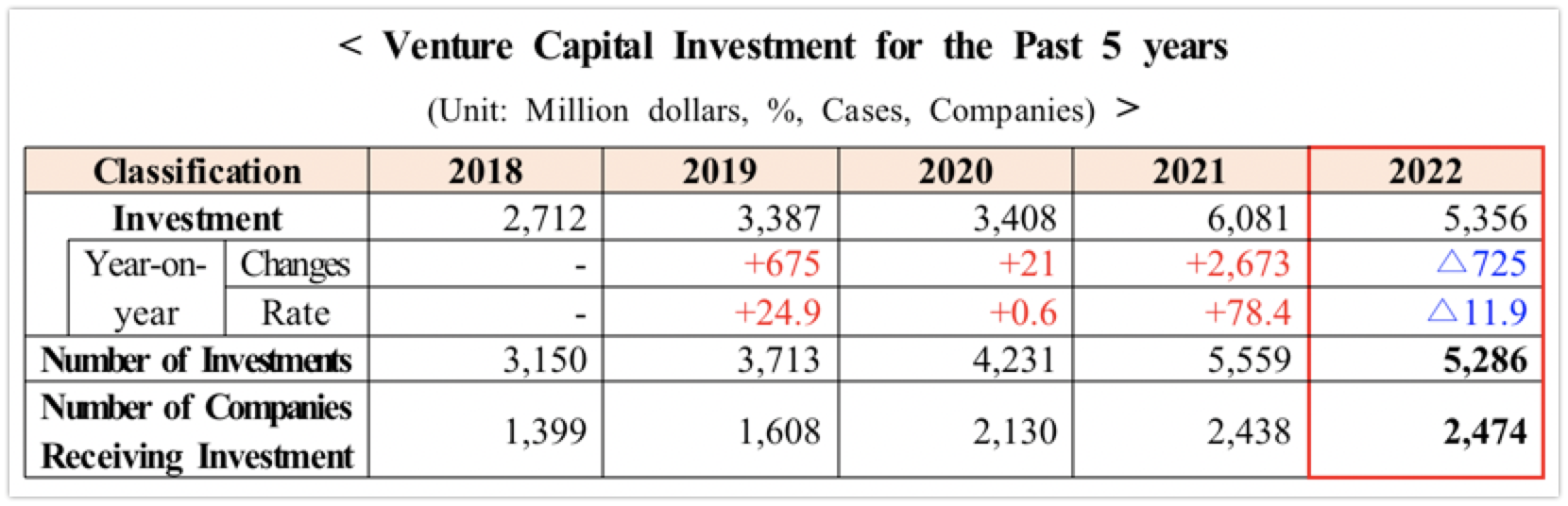

2022 venture capital investments amounted to KRW 6.764 trillion (USD 5.356 billion) which is a YoY decrease of 11.9%. Despite the decrease, the amount is the second largest in history following the historical high of 2021.

Due to the complex crises of high interest rates, high inflation, and high exchange rates, the amount of VC investment in 2022 for the United States decreased by 30.9%, and for Israel decreased by 40.7%. When compared to these numbers, the decrease in VC investment in Korea for the same period was relatively smaller.

Although there was active investment in the first two quarters, investments slowed down in the third quarter.

The amount of investment in the first quarter amounted to KRW 2.221 trillion (USD 1.759 billion), which is a 68.5% increase compared to the same period in 2021. The amount of investment in the second quarter also increased by 1.4% to KRW 1.932 trillion (USD 1.529 billion), marking a record high for the second quarter.

However, the amount of venture capital investment in the third quarter amounted to KRW 1.284 trillion (USD 1.017 billion) which is a decrease of 38.6% compared to the same period last year, and the amount also decreased by 43.9% in the fourth quarter to KRW 1.327 trillion (USD 1.051 billion).

This may be because investments that were reviewed before the market tightened were implemented up to the first half of the year, whereas starting from the third quarter, high interest rates and high inflation* greatly affected the venture capital investment market.

70.5% of the investment was focused on three industries of ICT services, retail and services, and bio and healthcare.

The ICT service industry attracted the highest amount of investment of KRW 2.352 trillion (USD 1.862 billion) (34.8%). However, due to the recent market difficulties, the amount decreased by 3.2% compared to 2021.

On the other hand, bio and healthcare attracted KRW 1.106 trillion (USD 875.5 million), making it an attractive industry to invest in, following ICT services (KRW 2.352 trillion (USD 1.862 billion)) and retail and services (KRW 1.313 trillion (USD 1.039 billion)), yet the amount decreased by 34.1% compared to 2021 due to drops in the stock prices of listed bio companies, and stricter technology-based special listing.

Also, the video, performance, and record industry increased by 10.6% compared to 2021 to KRW 460.4 billion (USD 364.5 million). This may be attributed to the positive outlook from the good defence of the entertainment and video content stocks due to the global fad of K-pop and K-dramas, as well as the recovery of movie audiences due to eased social distancing measures.

By company age, early-stage startups (history of three years or less) were the only sector that saw an increase in investment.

Investment in early-stage startups increased by 7.8% compared to last year to KRW 2.005 trillion (USD 1.588 billion), exceeding KRW 2 trillion for the first time in history.

On the other hand, investments in middle-stage (history of 3-7 years) and late-stage (history of more than 7 years) companies decreased by KRW 2.731 trillion (USD 2.162 billion) and KRW 2.029 trillion (USD 1.606 billion), respectively.

This may be because the attractiveness of early-stage startups relatively increased, as it is possible to greatly negotiate prices and expect high profit rates in the mid to long term.

Vice Ministry CHO Ju-hyeon stated, “Despite record inflation, high interest rates, and other challenges, the amount of venture capital funds exceeded KRW 10 trillion (USD 7.9 billion) for the first time. Also, our investments fared relatively better than in other countries. This is thanks to the Korean venture capitalists who have worked day and night.”

At the same time, CHO added, “As the decrease is becoming greater, the most important task is to encourage suspended investments.”

Against this background, the Ministry of SMEs and Startups announced the Measures to Create a Dynamic Venture Capital Investment Ecosystem in November 2022, and has been working on measures to accelerate investments to prepare for market difficulties.

First, to quickly implement the incentives for early venture capital investments, which was a part of the measures, the Ministry will launch the First Regular Fund of Funds Investment Project which was announced on January 4, 2023.

Fund managers of fund of funds that met the investment goals will be given additional maintenance support and additional points when signing up for the Fund of Funds project next year.

In addition, to secure a foundation to attract large-scale private capital investment, private fund of funds will be implemented as soon as possible, and the taxation incentives included in the measures will also be legislated by reforming the law.

- ModuSign Secures 17.7 Billion KRW Series C Investment for E-contract Solutions

- [Korean Startup Weekly News #15] ‘Startup Korea Fund’ launched with KRW 500 billion from government and private investors

- SEOUL BIOHUB Global Center Opens, Aiming to Boost Global BioTech Competitiveness

- KDB Takes Korean Innovation to Silicon Valley: “KDB NextRound” Connects Startups with Global Investors

- Table Order Company T’Order Announces US and Global Expansion Plans for 2024

- Molecular Innovations raises a 200M KRW funding for developing pharmaceuticals with innovative materials

- LOGIBROTHERS Secures Strategic Investment from Grand Ventures to Expand AI Education Globally

- ISKRA Secures Strategic Investment from Animoca Brands to Boost Web3 Gaming

- ‘Startup Korea Fund’ launched with KRW 500 billion from government and private investors

- ‘Recl’ Raised Series A Funding to Lead the Used Clothing Market